Since 2010, Investments Leading to Large-scale Forest Destruction and Massive Carbon Emissions are 39 Times Larger than Money Funneled to Forest Protection

Satellite data shows record-high levels of forest loss in 2016; saving forests requires a massive shift in investment from activities driving deforestation to those designed to protect, restore and replant trees

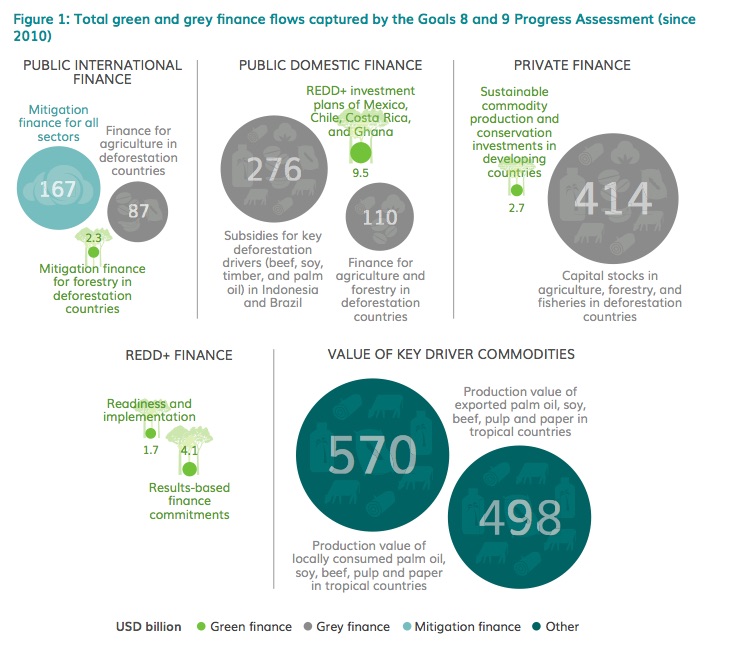

LONDON/BERLIN (24 October, 2017) —The investments and subsidies of governments, the private sector and international donors in agriculture and land-intensive developments—which total at least US$777 billion since 2010—completely dwarf the $20 billion invested in stopping deforestation and forest emissions, according to new research released today. The analysis came on the heels of new findings showing a drastic leap in forest loss, despite the New York Declaration on Forests (NYDF), a voluntary international agreement to halve natural forest loss by 2020 and end it by 2030. To ensure forests, a crucial climate solution, fulfill their potential to slow climate change, much greater attention and investment are needed to keep them standing.

Out of all investments committed by developed countries and multilateral institutions since 2010 to reduce climate change emissions around the world, only 2 percent of the $167 billion—$3.6 billion—has been dedicated to forests

The new study, Finance for Forests, found that even in public-sector climate finance, forests don’t receive enough investment compared to their potential contribution to mitigating climate change. Out of all investments committed by developed countries and multilateral institutions since 2010 to reduce climate change emissions around the world, only 2 percent of the $167 billion—$3.6 billion—has been dedicated to forests, according to the new report, the first-ever to tally the global state of forest finance. Yet scientific evidence shows that protecting and enhancing forests can provide as much as 30 percent of the climate change mitigation needed to meet the goals of the Paris Agreement.

Forests hold so much potential in the effort to limit climate change, and yet there’s a seemingly endless supply of money to help tear them down

“When looking at financing streams that can stop deforestation, we’re just not keeping up,” said Charlotte Streck, the co-founder and head of Climate Focus and a lead report author. “Forests hold so much potential in the effort to limit climate change, and yet there’s a seemingly endless supply of money to help tear them down. We need to turn the equation around and invest much more in keeping forests standing than in activities that destroy them.”

Research just released from Global Forest Watch underscores this problem, finding that the global annual rate of gross tree cover loss rose by an average of 35 percent between 2014-2016 compared to a 2001-2013 baseline. More than one-quarter (26.3 percent) of all tree cover loss around the world last year occurred in Brazil and Indonesia alone.

“Stopping deforestation will require a transformational shift that sees all investment flowing to forest countries going green,” said Justin Adams, Global Managing Director of Lands at the Nature Conservancy, a NYDF assessment partner. “Addressing poverty and hunger are critical, and development in Asian, Latin American, and African nations which are home tropical forests does not need to come at the expense of the environment. All finance, especially agricultural finance, can accommodate this new priority and respect that climate change has been added to the bottom line.”

If the NYDF is successful, the tropical forests left standing, as well as re-growing and restoring those which have been lost, could absorb 25 percent or more of future carbon emissions—equivalent to 4.5-8.8 billion tons of carbon pollution each year, as much as the United States’ current emissions.

The new report—coordinated by Climate Focus and the NYDF Assessment Partners—is the latest in an annual assessment of the progress made in the NYDF. If the NYDF is successful, the tropical forests left standing, as well as re-growing and restoring those which have been lost, could absorb 25 percent or more of future carbon emissions—equivalent to 4.5-8.8 billion tons of carbon pollution each year, as much as the United States’ current emissions.

Grey Finance Yields More Emissions and Fewer Trees

The 2017 research provided an in-depth assessment of the two NYDF goals that focus on the financing needed to reward positive actions and stop rampant global deforestation, driven by the clearing of forests for soy, cattle, palm oil, paper and other commodities.

The analysis explored the extent of so-called “grey finance”—investments that have a neutral, negative, or unknown impact on forests. Private finance in agriculture is the largest source of finance in the land use sector, with more than $414 billion invested in key regions since 2010, and dwarfs private finance for sustainable commodity production and conservation in developing countries. The export value of key forest risk commodities from tropical forest countries, $498 billion, is more than 225 times larger than the $2.7 billion that has been invested in sustainable commodity production.

The agriculture sector is responsible for 70 percent or more of global deforestation, yet since 2010 deforestation countries received $87 billion in development finance for agriculture.

Governments in deforestation countries invest significantly larger amounts of grey finance than green finance, especially in the agricultural sector. Brazil and Indonesia, for example, have spent an estimated $276 billion supporting the beef, soy, palm oil, timber, and other industries that drive deforestation. The agriculture sector is responsible for 70 percent or more of global deforestation, yet since 2010 deforestation countries received $87 billion in development finance for agriculture.

“If we are serious about meeting the goals of the Paris Agreement, we need to funnel finance to conserving and restoring forests,” said Nancy Harris, research manager at Global Forest Watch, a NYDF assessment partner. “Forests have other benefits beyond just reducing carbon in the atmosphere—they support the livelihoods of local communities, and can regulate rainfall patterns regionally and globally as the world strives to reduce carbon in the atmosphere, we need to invest more in trees as an effective carbon capture and storage system.”

The report suggests that despite opportunities for increased yields and profitability, private investors face challenges in finding viable sustainable land use projects.

We need a much more dramatic pace of green investment, and shift away from some grey activities if we are to sustain economic growth.

“Yet the climate is already changing,” said Charlene Watson, a climate finance expert at ODI, a NYDF assessment partner. “We need a much more dramatic pace of green investment, and shift away from some grey activities if we are to sustain economic growth. So much is at risk, we need the public sector to provide stronger policy and financing signals in the land use sector that help set the right conditions for great private investment.”

Not only the public sector, but also banks, have a role to play in promoting sustainable private investment to reduce forest impacts in commodity supply chains. A limited number of financial institutions have adopted policies to address forest risks from land use investments, but few set mandatory requirements for their clients, and there is a lack of transparency around these efforts.

“The transition from deforestation-intensive projects to sustainable land use can only be achieved with a dramatic shift of finance,” said Streck. “While countries and companies endorsing the NYDF have moved forward on a number of goals, the financing strategies behind this progress have not kept up. We know that a business case can easily be made for stopping deforestation, but the work on the ground still needs more resources and better uses of these resources.”

About the New York Declaration on Forests Assessment Partners

The NYDF Assessment Partners are an independent network of civil society groups and research institutions that annually evaluates the progress toward meeting the ten goals formulated in the NYDF. Meeting the goals of the NYDF requires the ongoing resolve of its endorsers. Effective monitoring on progress, engagement and visibility of results is important to boost this resolve. The NYDF Assessment Partners serve as a platform to facilitate these efforts. Partners (in alphabetical order) include: CDP, Chatham House, Climate Focus, Environmental Defense Fund, Forest Trends, Global Alliance of Clean Cookstoves, Global Canopy Programme, International Union for the Conservation of Nature, Rainforest Alliance, Stockholm Environment Institute, The Nature Conservancy, The Sustainability Consortium, Woods Hole Research Center, World Resources Institute, World Wildlife Fund.

About the New York Declaration on Forests (NYDF)

The New York Declaration on Forests (NYDF) is a voluntary and non-binding international declaration to take action to halt global deforestation. It was first endorsed at the United Nations Climate Summit in September 2014, and by September 2016 the NYDF supporters had grown to include 191 endorsers: 40 governments, 20 sub-national governments, 57 multi-national companies, 16 groups representing indigenous communities, and 58 non-government organizations. These endorsers have committed to doing their part to achieve the NYDF’s ten goals and follow its accompanying action agenda.

For more information, please contact:

Susan Tonassi (stonassi@burness.com; +49 160 932 79327)

Ingrid Schulte (i.schulte@climatefocus.com; +49 172 210 8783)

The Sustainability Consortium® | ©2018 Arizona State University and University of Arkansas

The Sustainability Consortium® | ©2018 Arizona State University and University of Arkansas

Shutterstock / Fedorov Oleksiy

Shutterstock / Fedorov Oleksiy